Chandigarh, October 1, 2020: HDFC Bank has updated its customers about The Finance Act 2020, new Income Tax provisions which have been introduced on all forex transactions under LRS (Liberalised Remittance Scheme) from 1st Oct'2020.

Here are the new provisions as per ‘The Finance Act, 2020’:

• Tax Collected at Source (TCS) at 5% shall be applicable on aggregate forex transactions under LRS exceeding INR 7 Lakhs in a financial year.

• For transfers from Resident Individual Account to NRO Account towards Gift / Loan, TCS will not be applicable & the amount transferred will not be subsumed under the aggregate threshold limit of INR 7 Lakhs per FY mentioned above.

• For remittances towards pursuing overseas education, TCS at 0.5% shall be applicable, if the amount remitted is obtained through a loan from a financial institution.

• For remittances to Foreign Tour Operators through the Bank, 5% TCS of the total amount remitted shall be applicable and the amount remitted will not be subsumed under the threshold limit of INR 7 Lakhs mentioned above.

• The TCS rates mentioned above are to be increased by applicable surcharge as well as Health and Education Cess in case a remitter is non-resident as per the Income-Tax Act, 1961.

• The above provisions will be effective from October 1, 2020.

Frequently Asked Questions (FAQs):

1. What is Liberalised Remittance Scheme (LRS)?

Under this Scheme, all resident individuals, including minors, are allowed to freely remit / avail foreign exchange facility up to USD 2,50,000 per financial year (April – March) for any permissible current or capital account transaction or a combination of both.

2. What is the new tax implication on all forex transactions under LRS?

TCS at 5% shall be applicable on all forex transactions under LRS, exceeding INR 7 lakhs in a financial year (Except, i) Transfers from Resident Individual Account to NRO Account towards gift / loan, wherein TCS is NOT applicable AND ii) Remittances towards overseas education made out of loan obtained from a financial institution, for which TCS at 0.5% will be applicable).

For instance, if the total foreign exchange facility availed under LRS in a financial year is INR 10,00,000, TCS at 5% will be applicable on INR 3,00,000 (INR 10,00,000 - INR 7,00,000) and tax collected will be INR 15,000. If subsequent LRS transaction initiated is INR 2,00,000, TCS @ 5% will be applicable on INR 2,00,000 and tax collected will be INR 10,000.

3. What is the tax implications for transfers to NRO Account towards Gift / Loan, under LRS, by Resident Indian?

TCS will NOT be applicable and the amount remitted will not be subsumed while considering the threshold limit of INR 7 lakhs per Financial Year.

4. What is the new tax implication on remittances for pursuing overseas education?

TCS at 0.5% shall be applicable on the amount exceeding INR 7,00,000 in a financial year under LRS, if the amount remitted is obtained out of a loan from a Financial Institution for pursuing education.

For instance, if the total amount remitted under LRS in a financial year is INR 10,00,000 for pursuing overseas education, TCS at 0.5% will be applicable on INR 3,00,000 (INR 10,00,000 - INR 7,00,000) & tax collected will be INR 1,500.

(Note: The threshold limit of INR 7 lakhs mentioned in FAQs 2 & 3 is a consolidated threshold limit).

5. What is the tax implication if the amount remitted for pursuing overseas education is Owned Funds (not a loan availed)?

TCS at 5% shall be applicable on remittances exceeding INR 7 lakhs in a financial year under LRS.

6. What is the tax implication for remittances to Foreign Tour Operator under LRS?

TCS applicable will be at 5% of the total amount remitted and the amount remitted will not be subsumed while considering the threshold limit of INR 7 lakhs limit.

For instance, if the amount remitted is INR 5,00,000, TCS at 5% will be applicable and tax collected will be INR 25,000.

7. What is the effective date of the new income tax provision?

The new TCS provision will be effective from October 1, 2020.

8. Which transactions are included in threshold limit of INR 7 lakhs, above which TCS shall be applicable?

All forex transactions under LRS will be included in threshold limit of INR 7 lakhs except i) Transfers from Resident Individual Account to NRO Account towards Gift / Loan and 2) Remittances to Foreign Tour Operators.

9. How TCS will be calculated?

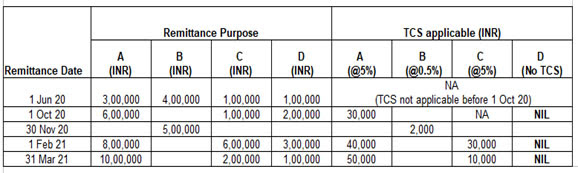

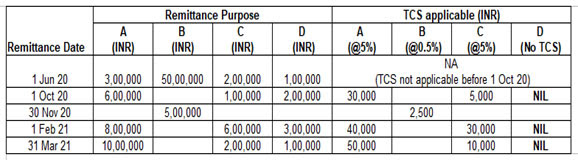

Below illustration explains how TCS will be calculated if Mr. XYZ avails foreign exchange facility for different purposes under LRS as listed below.

A – Remittances towards Overseas/ Foreign tour programme package

B – Remittances for pursuing overseas education

C – Other LRS Remittances

D – Transfers to NRO Account under Gift / Loan

Illustration I: TCS calculation if the Mr. XYZ has not utilized the threshold limit of INR 7 Lakhs per FY before October 1, 2020

llustration II: TCS calculation if Mr. XYZ has already utilized the threshold limit of INR 7 Lakhs per FY before October 1, 2020

(Note: The above illustration applies for financial year 2020-21. For financial year 2021-22, TCS will be applicable effective April 1, 2021 subject to any further changes in the provisions.)

10. How TCS on LRS transactions would be computed for FY 2020-21 with reference to threshold limit of INR 7 lakhs, as the said TCS is applicable from 1-Oct-2020.

TCS on all forex transactions under LRS shall be applicable from October 1, 2020. However, for tracking the threshold limit of INR 7 lakhs, all forex transactions under LRS (except, i. transfers from Resident Individual Account to NRO Account towards Gift / Loan and ii. remittances to Foreign tour operators done through the Bank) made from April 1, 2020 would be considered, as illustrated in the tables above.

11. How TCS on LRS transactions will be calculated for FY 2020-21 if I have availed forex facility under LRS in excess of INR 7 lakhs in a Financial year before 1st October 2020?

Please note that the foreign exchange facility availed by a Resident Individual Customer under LRS before 1st October 2020 are aggregated for arriving / tracking the threshold limit of INR 7 Lakhs only and not for applying TCS on those drawls which are made before TCS rules are effected. TCS shall be applicable on taxable LRS transactions with effect from 1st October 2020.

For example, in Illustration II table (FAQ 9), The customer had drawn INR 52 Lakhs (aggregate of B+C) under LRS before 1st October 2020.

When that customer draws forex under LRS for INR 1 Lakh (under item C) on 1st October 2020, the aggregated drawl by the customer under LRS in FY 2020-21 amounts to INR 53 Lakhs.

Thus, the customer has already crossed the threshold limit of INR 7 Lakhs for FY 2020-21 for reckoning TCS on LRS transactions.

Hence, TCS shall be applicable on the customer’s transaction of INR 1 Lakh on 1st October 2020 at applicable rates (5% for items in C column) and hence, TCS of INR 5,000/- is levied.

12. Will TCS be applicable if foreign exchange facility is availed in Cash / Forex cards?

Yes, TCS at 5% will be applied on LRS transactions exceeding INR 7 lakhs if foreign exchange facility is availed through FCY Cash withdrawal at Branches / loading Forex cards.

Foreign Exchange facility availed through FCY Cash / Forex cards towards Overseas Education out of a loan from a Financial Institution attracts TCS @ 0.5% on drawl exceeding INR 7 lakhs in a Financial Year under LRS (TCS @ 5% shall be applicable in case amount drawn is not obtained out of loan from a Financial Institution).

FCY Cash / Forex Cards availed towards Overseas / Foreign tour programme, will attract TCS @ 5% and the amount drawn shall not be subsumed under the aggregate threshold limit of INR 7 lakhs.

13. In case of minor accounts, the threshold limit (INR 7 lakhs) of the minor or guardian will be utilized?

If the PAN updated on the account is of the Minor, the threshold limit of the Minor will be utilized. However, if Guardian's PAN is updated on the account, the threshold limit of the Guardian will be utilized. Accordingly, TCS would also be collected in the name of the person (minor or guardian) whose PAN has been updated on the account.

14. What is the applicable TCS if PAN card is not updated on Bank's records?

Foreign Exchange facility under LRS can be availed only if your PAN is updated on Bank's record.

15. Will GST be applied on the TCS amount?

GST will not be applicable on the TCS amount.

16. What are the scenarios under which the provision will not apply?

The provision will not apply in case the remitter is liable to deduct tax at source under any other provision of the act and the amount has been deducted and if the remitter is Government or any another person notified by the Government.

17. If remitter/ customer can avail tax credit of the TCS?

Yes, remitter / customer can claim credit for the tax collected by the Bank while filing for their tax returns.